【Market Map】The Crazy-Growing Youth English Training Market in China (Part 1)

In the recent few years, the English training market for kids are growing rapidly in China, and more and more companies have been competing for a part of this huge piece of cake:

· In Nov 2015, iTutorGroup raised 200 million USD of C Round funding;

· In Jun 2016, 51Talk was listed in NYSE with a market cap of 338 million USD as of end of May 2017;

· In Aug 2016, VIPKID secured 100 million USD of C Round funding and were endorsed by Kobe Bryant;

· In Dec 2016, DaDaABC was also funded with several hundred million RMB.

How is the Market Segmented?

In China, the youth English training market can be divided into two groups. First one is for teenagers aged between 12 to 18 years old who are more focused on the exam results or the demand for overseas study. 5–12-year-olds define another group where the English study is less exam-oriented.

The mainstream English classes are delivered in two methods: live-streaming or non-live-streaming. Live-streaming has become extremely trendy for the past few years fuelled by the fast improvement of related technologies and higher demand for native-speakers as tutors. On the other hand, the non-live-streaming products are more content provider or English learning tools.

Fast Growing Market

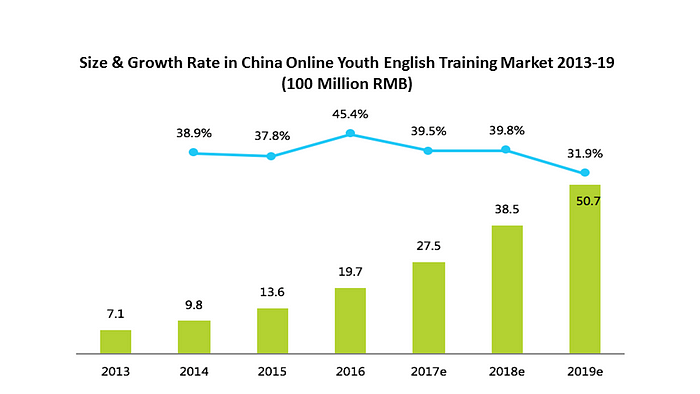

According to the estimation of iResearch, the size of online youth English training market is around 1.97 billion RMB with an annual growth of 45.4%. With an increasing size of the user population, it is projected to become a 5 billion RMB market.

It’s also a very popular sector for investors. Apart from the big names mentioned above, there are 14 online youth English training providers who have raised funds in 2016. 10 out of these 14 cases are based on online tutoring with native-speaker teachers.

Potential Cooperation Opportunities

What do these Chinese companies need from you? We conclude that the demand for international resources mainly comes from 5 aspects:

- Academic Research: Some Chinese companies are looking for international scholars and research organisations that focus on AI, big data, pedagogy and linguistics researches.

• Examination Partners: to cooperate with international exam facilities or centres to acquire the authorization of the international English exams taken domestically.

• Teacher Recruitment and Training: To recruit native English speakers as English tutors as well as to partner with teaching research organisation or educational companies to provide teacher training and related qualifications.

• Short-term overseas study for students or overseas internship/training for teachers.

• Curriculum Design and Publishers. Many companies in this market would like to cooperate with educational companies and publishers to work on the curriculum design or localise the international English learning materials.

JMDedu is the №1 B2B EdTech Media in China, that informs and connects business professionals through our reports, events, and information services. Our mission is to drive the advancement of education. Our network is across education industry in China as well as globally. GETChina, operated by JMDedu, aims to connect China and the rest of the world and help international players to start and succeed in China.

GET (Global Education Technology) Summit and Expo is a dedicated platform for excellent education practitioners to share their insights, experience and solutions. We set to discover inspiring education products and services from around the world and revitalize education through innovation and collaboration. This year it will be on 14–16th November in Beijing! You can reserve your place HERE and if you any question or confusion, email us at global@jmdedu.com and we are happy to help!